Table of Contents

Understanding your financial flow can make the difference between thriving and just surviving. As a mid-sized business generating significant figures, have you wondered why certain sales haven’t contributed to your cash flow yet? The answer lies in “deferred transactions.” But what exactly are these deferred transactions, and how do they impact your business’s bottom line? Let’s break it down and offer strategies to optimize your cash flow through better management of deferred transactions on Amazon.

What Are Deferred Transactions?

Deferred transactions are sales proceeds that Amazon temporarily holds back. The intention is to ensure that customers have received their orders in satisfactory condition, and there are adequate funds available to manage potential returns, claims, or chargebacks. Such transactions come with specific conditions involving delivery completion confirmation and financial security for any issues that can arise post-sale.

Key Reasons for Transaction Deferral

- Delivery Date Policy (Orders Awaiting Delivery) : Funds are put on hold until Amazon confirms that the delivery promise has been fulfilled. This ensures sellers have ample funds to address issues like returns or claims.

- Invoiced Orders (Orders Pending Buyer Payment): In the case of business-to-business transactions, funds are deferred while waiting for the buyer to process the invoice. These transactions are bound by the same delivery confirmation, but the settlement relies heavily on invoice payment timelines, usually 30–45 days post-order.

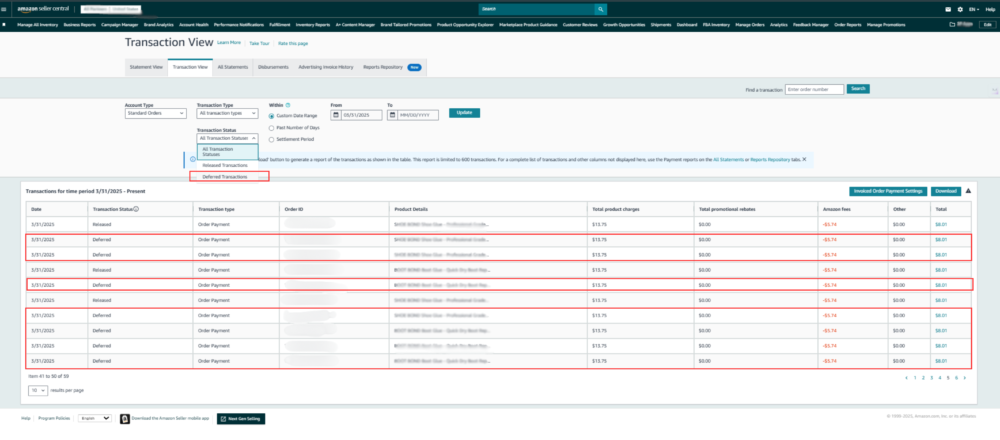

How to Monitor Deferred Transactions

To keep tabs on your deferred transactions, here’s a quick guide:

- Navigate to the Transaction View page in Amazon Seller Central.

- Select “Deferred transactions” in the Transaction Status dropdown menu.

- Click “Update,” and view the reasons for deferral alongside expected payment release dates.

Remember, these transactions only appear in your reports once they’re released, meaning proactive monitoring is crucial to understanding your cash flow status.

Understanding Delivery Date Reserves

Delivery date reserves are safety nets that Amazon places on your funds, ensuring you have enough resources to cover financial commitments like returns or refunds. This reserve period generally lasts an additional seven days after delivery (DD + 7 policy).

Impact on New or Growing Accounts

For sellers encountering this for the first time or those ramping up their sales, it’s common to see all your funds in reserve. This restriction is primarily due to the reliance on recent delivery data within those reserve parameters.

Strategies to Accelerate Payment Release

Want to speed up access to your funds? Here are some actionable strategies:

- Prompt Dispatch: Quickly ship and confirm dispatch of your items in Manage Orders as soon as possible.

- Accurate Tracking: Always use integrated carriers and provide valid tracking numbers to reassure buyers and Amazon that the package is en route.

- Opt for Faster Deliveries: Speed up your delivery methods to narrow the time between shipment and delivery.

Determining Shipment Delivery Dates

Amazon prioritizes valid tracking data to establish actual delivery dates. In its absence, they’ll use the latest estimated date, so make sure you supply accurate and timely information.

Turn Deferred Transactions Into Predictable Profits

Amazon’s payment structure can either fuel your growth or choke your cash flow the difference lies in how you manage deferred transactions. Smart sellers don’t just track payments; they forecast, optimize, and strategize to maintain financial stability and operational flexibility.

At Adverio, we help Amazon brands take control of their cash flow ensuring you’re not just getting paid, but getting paid at the right time to scale profitably.

The next step? Stop reacting, start optimizing. Partner with Adverio today and turn financial clarity into a competitive advantage.